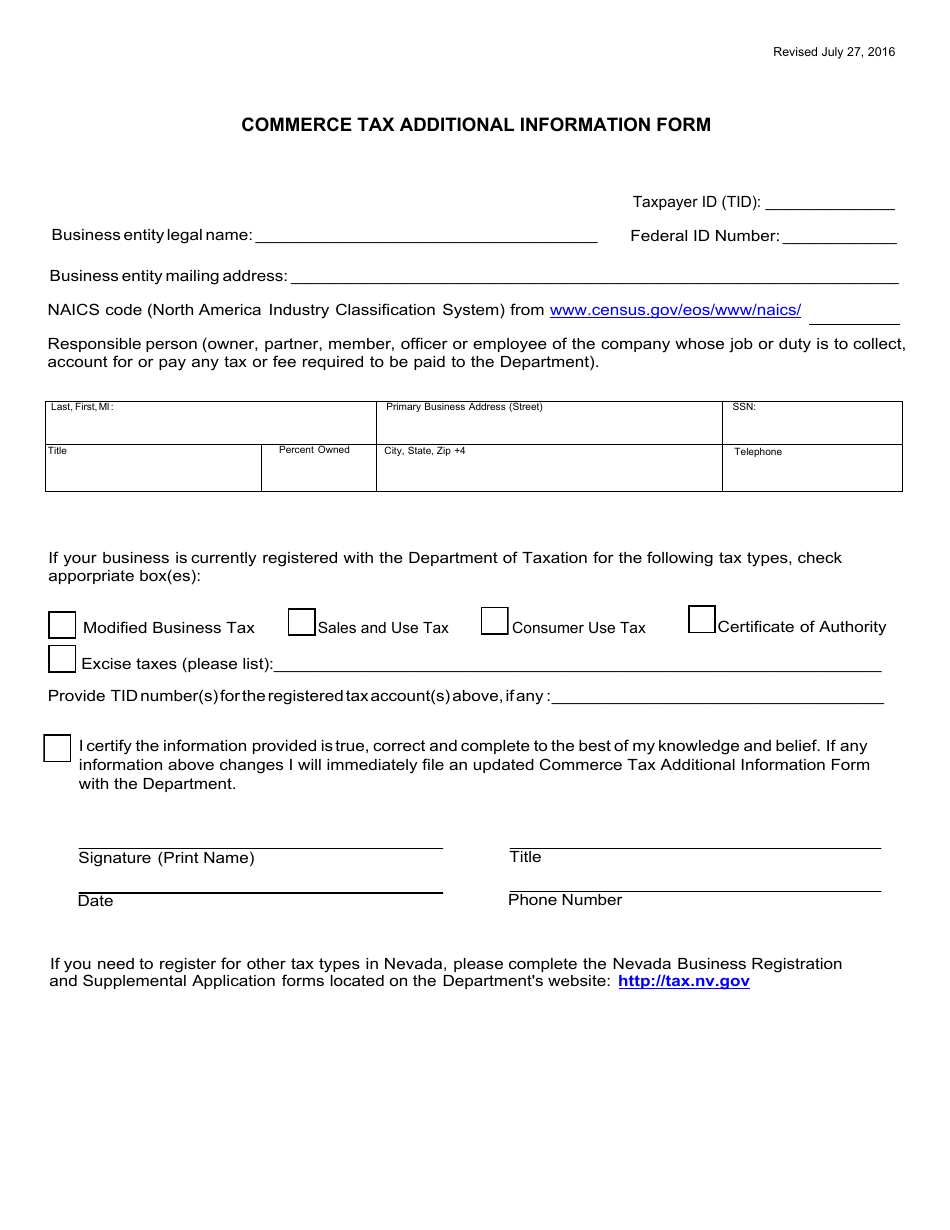

Commerce Tax Additional Information Form is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

Q: What is the Commerce Tax?

A: The Commerce Tax is a tax imposed on businesses in Nevada.

Q: Who needs to pay the Commerce Tax?

A: Most businesses with gross revenue exceeding $4 million in Nevada need to pay the Commerce Tax.

Q: How is the Commerce Tax calculated?

A: The Commerce Tax is calculated based on a Nevada business's gross revenue.

Q: When is the deadline to file the Commerce Tax?

A: The deadline to file the Commerce Tax is the 15th day of the month following the end of the fiscal year.

Q: What is the penalty for late payment or non-payment of the Commerce Tax?

A: Penalties for late payment or non-payment of the Commerce Tax include interest charges and potential collection actions.

Q: Are there any exemptions from the Commerce Tax?

A: Yes, certain entities, such as non-profit organizations and some small businesses, may be exempt from the Commerce Tax.

Q: What information is required on the Commerce Tax Additional Information Form?

A: The Commerce Tax Additional Information Form requires specific information about a business's gross revenue and other related details.

Form Details:

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.